With the ongoing economic crisis and high inflation rate, smartphone users are now turning to online financial apps to help them with their budget and savings. During the COVID-19 pandemic, the global lockdown forced users to install many apps for entertainment purposes or for online shopping and video communication. With the end of the curfew, demand for such apps started to decline. However, demand for financial management apps was still high due to the global economic slump. In one year, nine million Android users connected with such apps.

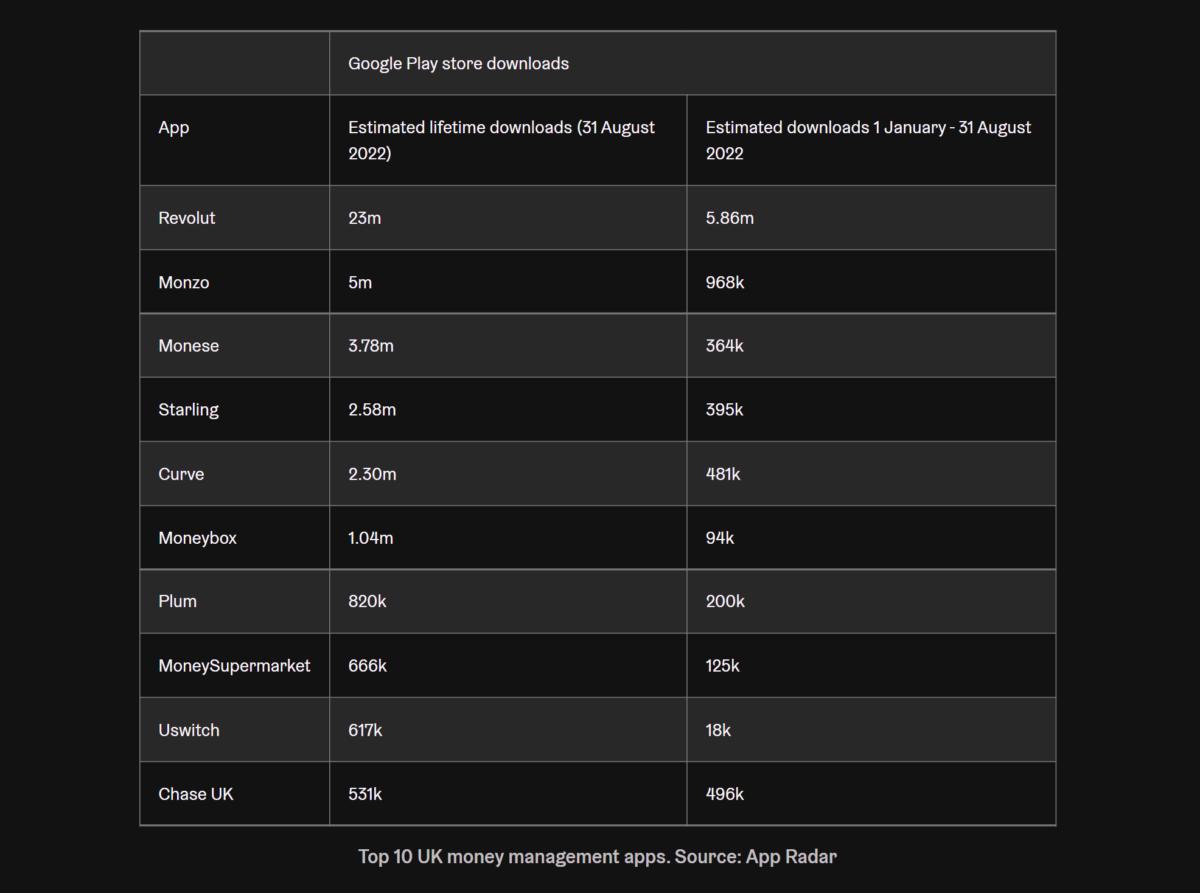

According to one of App Radar's latest surveys, there has been a forty percent increase in the installation rate in the UK alone. And nearly forty million users have made their debut on the top apps in this category. Currently, Revolut tops the top app list with nearly 6 million users. And it is followed by Monzo with 896 thousand users. The Revolt app has managed to boost the platform's performance by up to 25%. Not only that, applications to process retired employees' incoming money also increased by fourteen percent in 2022.

Also See: Criteria for Investors in Startups

The Popularity of Finance Apps is Growing

The idea of saving cash is more powerful than investing. This can be confirmed by the study report showing a thirty-six percent drop in online investment applications. With virtual currency becoming highly popular, such applications have made a huge impact, leading to more than one hundred million installs, almost three times more than what they observed two years ago.

According to Silvio Peruci, MD of App Radar, the current circumstances have made users more sensitive to managing their savings at lower expenses rather than investing them in other projects. This thinking can be seen as a reflection of the speed of deployment of these two platforms.

A drop in investment does not mean the end of this industry. Instead, all these platforms need to find users with savings who are willing to invest to preserve the value of their assets. For this, such apps will have to work twice as hard to come up with ideas that can help them.

No comments yet for this news, be the first one!...