Let's get to know the most successful traders of all time. We will explore their stories, successes and strategies. Throughout human history, rich people have always been a subject of curiosity as a symbol of wealth. Sometimes kings, emperors, princes or merchants, sometimes entrepreneurs from the world of technology and finance have carried this title. Today, billionaires, whose numbers are increasing day by day around the world, are among the most powerful names shaping the world economy.

Also See: Reddit plans to publicly launch in the second half of 2023

How did these people, who stand out with their multi-billion dollar fortunes, achieve success?

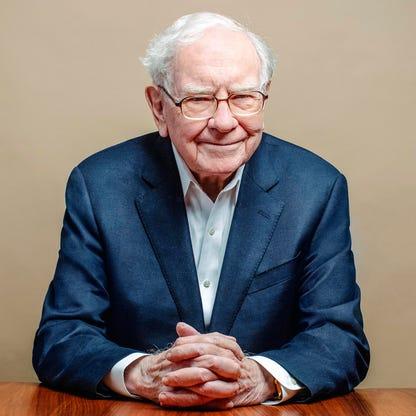

Warren Buffet ($106.8 billion)

Warren Buffet is an American businessman and investor. Born in 1930, Buffet was born in Nebraska. He became interested in investments at an early age, as his father was an investment expert. In the 1950s, he studied at Columbia Business School and attended Benjamin Graham's lectures. Benjamin Graham was an investor and author who developed the investment strategy known as "value investing" and was Buffet's mentor.

Buffet took control of Berkshire Hathaway in 1965. Since then, he has built the company into a worldwide holding company and increased his wealth by investing in many industries. Berkshire Hathaway operates in many industries, including insurance, retail, energy, telecommunications, financial services and transportation. Buffet is also known for his investment advice. His investment philosophy is based on long-term investing and he advocates that investee companies should have a strong fundamental analysis. Berkshire Hathaway is an American holding company and has many subsidiaries operating in many different industries. Some important Berkshire Hathaway subsidiaries are:

He also invests in shares of Berkshire Hathaway, American Express, Coca-Cola, Bank of America, Apple, Amazon, Verizon and many other major companies.

George Soros ($6.7 billion)

George Soros is a Hungarian-born American businessman and financier. Born in 1930 in Budapest, Soros fled Nazi-occupied Hungary during World War II and immigrated to England. Here he received a good education and became interested in financial markets. In 1969, he founded the investment fund Soros Fund Management in New York. Famous for his investment strategies, Soros is also known for his speculative transactions in the world financial markets. He became especially famous in 1992 when he made billions of dollars with a speculative trade against the British pound.

Soros Fund Management (SFM), the investment company of George Soros, has a broad portfolio of investments. SFM invests in companies operating in financial services, healthcare, energy, technology, transportation and many other sectors. Some notable SFM portfolio companies include:

SFM also invests in the shares of several major banks, other financial services companies and real estate investment trusts.

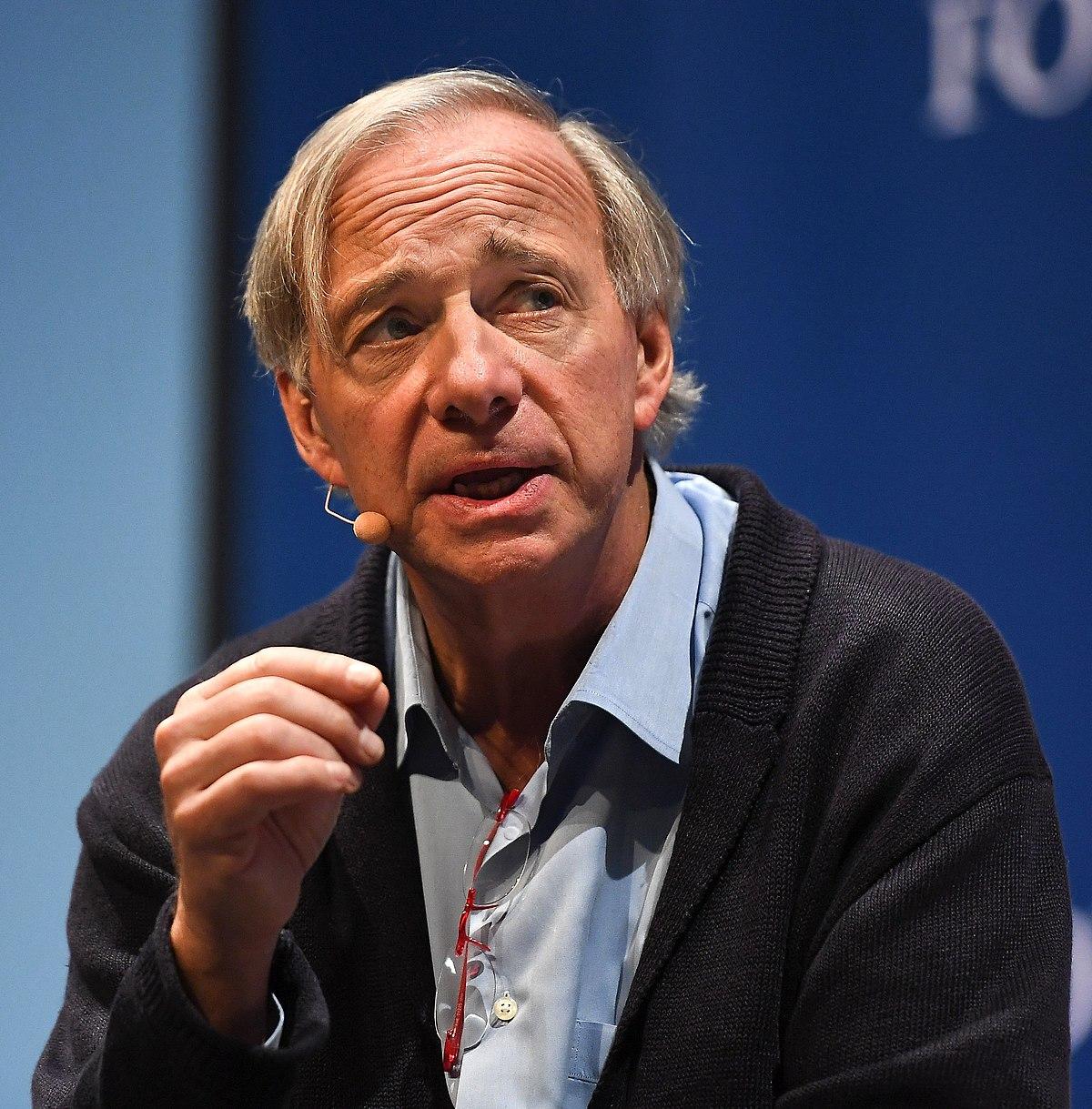

Ray Dalio

Ray Dalio is an American investor, hedge fund manager and founder of the hedge fund Bridgewater Associates. Dalio was born in New York City in 1949. He began his career in investment banking and later founded Bridgewater Associates. Bridgewater Associates is one of the largest hedge funds in the world and manages more than $150 billion in assets worldwide.

Dalio is known for his theory of economic cycles. According to this theory, he argues that economic cycles are predictable and investors should determine investment strategies based on these cycles. Also, in his book "Principles", Dalio shares his teachings on the challenges he faced in his life and how he managed to become a successful businessman.

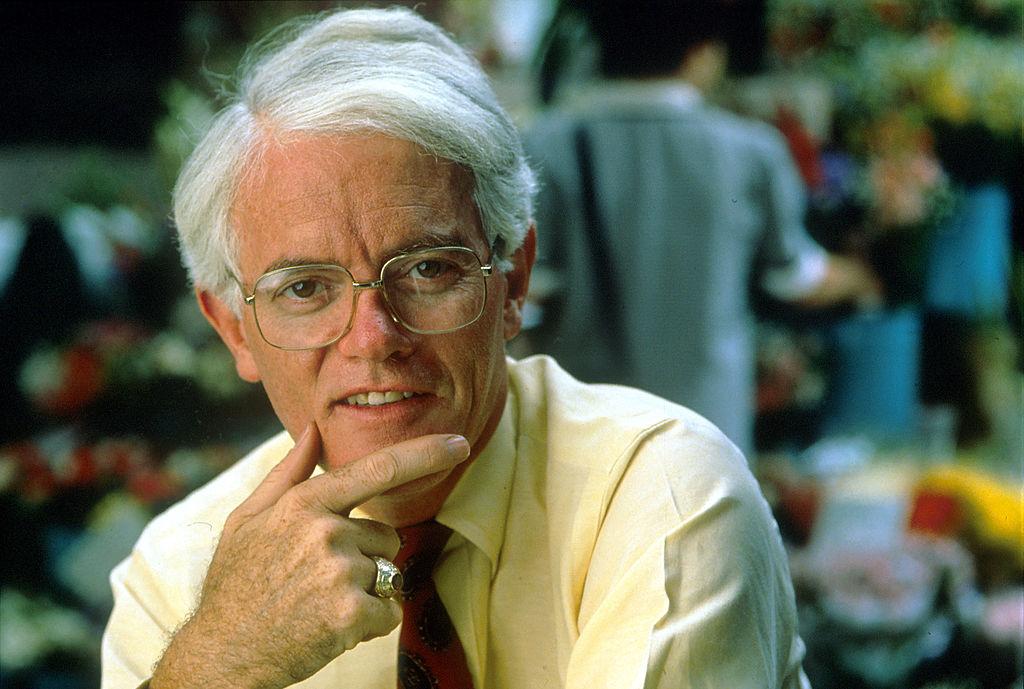

Peter Lynch

Peter Lynch is an American investor and fund manager born in Massachusetts in 1944. He was a director at Fidelity Investments from 1977 to 1990, during which time he managed the Fidelity Magellan Fund. Lynch was recognized as one of the most successful fund managers when he managed the Magellan Fund, which grew from approximately $18 million in 1977 to $14 billion in 1990.

Lynch's investment philosophy is based on knowing companies well, researching the products and services of investee companies, analyzing factors such as financial ratios and industry trends, and evaluating potential investment opportunities. Lynch also advised that investors should consider which companies produce the products and services they encounter in daily life and how they perform. Lynch has won many awards for his achievements in the investment world and has written numerous books and articles on financial advice and investing. Peter Lynch has won many awards throughout his investment career. The awards include:

Peter Lynch has also written numerous books on investing. His books include:

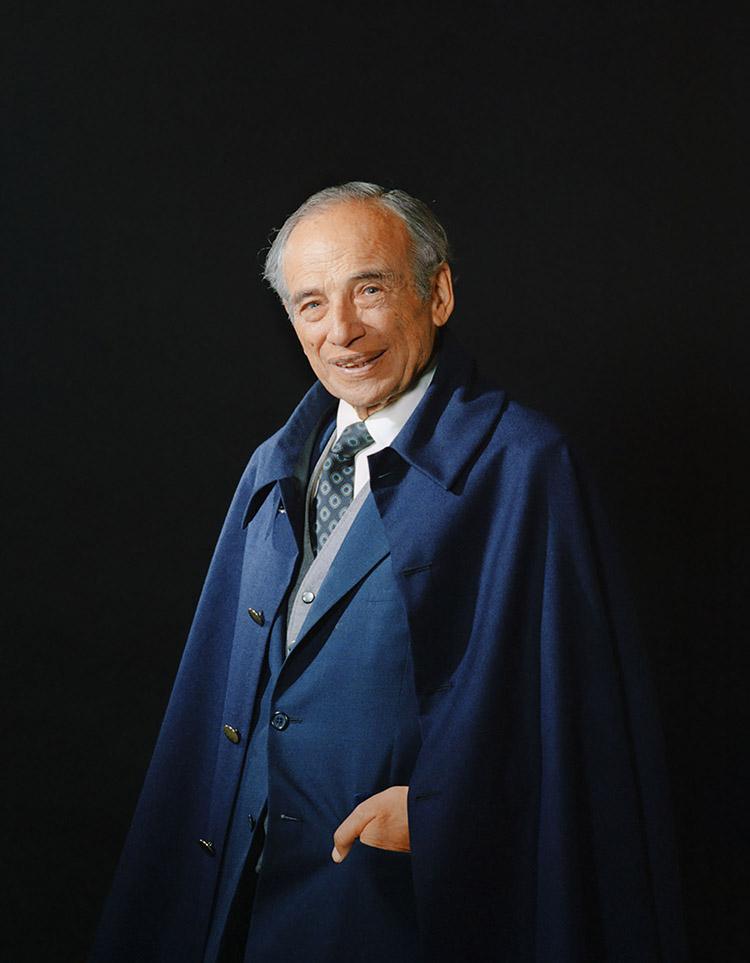

Benjamin Graham

Benjamin Graham was an American investor, economist and investment expert who lived between 1894 and 1976. He is considered the father of modern investment theory and influenced the investment approach of many investors. Graham brought a new perspective to investment analysis by writing the book "Security Analysis" published in 1934. The book presented analytical methods that helped investors calculate the true value of stocks. Graham was a lecturer at Columbia University and wrote many articles on investing. Graham's concept of "margin of safety" is still considered an important principle in determining the value of an investment.

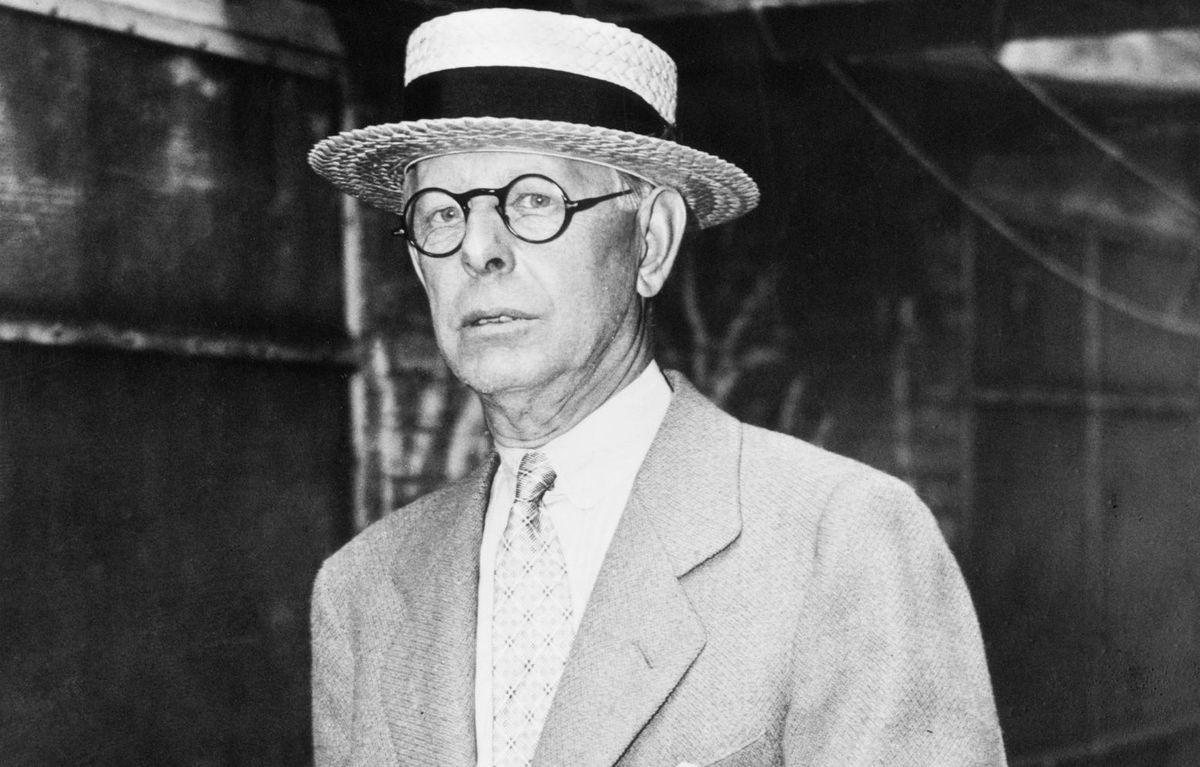

Jesse Livermore

Jesse Livermore is an American investor and stockbroker. Born in 1877, Livermore is known in the stock market world as the "Werewolf of the Stock Market". Livermore left school at the age of 14 and started working for a stock broker. During this period, he learned to trade on the stock exchange and made a lot of money in a short time. During the great panic in 1907, he earned 3 million dollars by correctly predicting the fluctuations in the market. Livermore also stood out with his accurate predictions during the great stock market crash of 1929. During this period, he earned 100 million dollars by making short trades, predicting that the market would fall.

What is the Secret to Becoming a Successful Investor?

Famous investors are known for their strategies and advice when investing. Here is the advice of some famous investors and the secrets of being a successful investor:

Warren Buffett: "If you don't know anything about the companies you are investing in, don't buy the stock." This advice emphasizes the importance of doing good research and knowing the companies well when investing.

George Soros: "Learning to lose is an important part of winning." A successful investor must have risk management strategies to minimize losses.

Ray Dalio: "The best investment opportunities are investing in the opposite of what everyone else wants to buy at the same time." Instead of following the investment trends followed by the crowd, a successful investor should apply a different strategy.

Peter Lynch: "Understand the business model of the companies you invest in." A successful investor should understand the business model and industry trends of the companies they invest in.

Benjamin Graham: "Choose companies to invest in based on their value, not their price." A successful investor should focus on the real value of companies rather than their stock prices.

Jesse Livermore: "Don't trade against the direction of the markets." A successful trader should follow trends rather than trade against market trends.

No comments yet for this news, be the first one!...